With the new financial year upon us, it is important to consider what is changing for Self-Managed Super Funds (SMSF) starting 1 July 2023. A summary of the key changes for Self-Managed Super Funds is outlined below, so you can plan for the year ahead.

1. Super Guarantee Rate

On 1 July 2023, the super guarantee charge (SGC) will rise from 10.5% to 11%. If you have employees, you will need to ensure your payroll and accounting systems are updated to incorporate the increase to the super rate.

2. Concessional and Non-Concessional Contribution Caps

From 1 July 2023, the superannuation concessional (pre-tax) and non-concessional (after-tax) contribution caps will remain at their current levels. The contribution caps for the 2023/2024 financial year are:

3. Work Test

Members aged 67-74 making non-concessional contributions or super guarantee contributions are not required to meet a work test. However, a work test will be required when the member makes a personal deductible. This rule applies to any contributions starting 1 July 2022.

Once a member turns 75, the fund can only accept super guarantee and downsizer contributions. Members will have 28 days after the end of the month they turn 75 to make any final voluntary contributions.

The 2023/34 year will be the final year to utilise any carry-forward concessional contributions from the 2018/19 year, provided the total super balance on 30 June 2023 is less than $500,000.

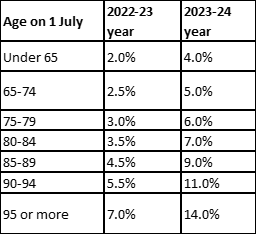

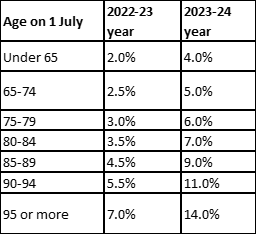

4. Minimum Pension Rates

Starting 1 July 2023, the below rates will apply. This is one of the key changes for Self-Managed Super Funds since minimum pension rate reverts to the original percentage and the 50% reduction will no longer apply.

Minimum pension payments must be cashed out of the super fund and will not be met if taken as an in-specie asset transfer.

5. Related party Limited Recourse Loan

The interest rate for SMSFs (self-managed super funds) relying on the safe harbour terms set out by the ATO for related party limited recourse borrowing arrangements has increased from 5.35% to 8.85% per annum for the 2023-24 financial year.

6. Transfer Balance Account Reporting

Tax agents are required to notify the ATO (Australian Tax Office) when withdrawals from superannuation – in excess of the minimum pension – when treated as a lump sum from the pension account – occur via a Transfer Balance Account Return (TBAR).

All super funds lodging a TBAR will be required to report within 28 days of the end of the quarter.

7. Total Superannuation and Transfer Balance Cap

One of the key changes for Self-Managed Super Funds in FY 2024 is the limit for total superannuation balance and transfer balance for members with no existing pension increases. From $1.7M last year, the cap has been increased to $1.9M.

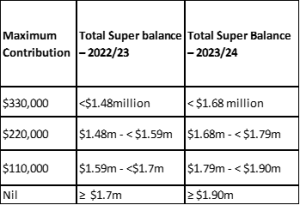

8. Bring Forward Rule

Members under 75 can bring forward up to three years of after-contributions in one year.

The bring forward rule is triggered if a member contributes more than the annual non-concessional cap in a single year.

For example, if you make a $330,000 contribution on 1 July 2022, you can only make further non-concessional contributions on 1 July 2025.

Any excess concessional contributions will also count towards the non-concessional cap.

9. Superstream Standards

Superstream will administer any superannuation employer contributions, rollovers, and release authorities. Release authorities include Division 293 tax, excess contribution determinations or commutations of excess transfer balance cap amounts.

Superannuation is complex, and implementing the right actions and strategies is important to ensure you maximise your superannuation savings. Connect with the right partners before making any decisions.

Our team’s industry experience and tax expertise will help you anticipate and navigate these changes, allowing you to plan for future opportunities and meet compliance responsibilities.